Black female authors are breaking boundaries and sterotype beliefs associated with personal finance.

The start of a new year is a great time to invest in yourself, and one of the best ways to do that is to increase your financial literacy. Money is a powerful tool that can be used to create generational wealth, build financial security for you and your family, and avoid the pitfalls of debt that so many of us fall victim to within the black community.

If you’re ready to begin the road to financial success but are unsure where to start, you’re in the right place! In this post, we’re sharing ten books authored by black women that bring a unique perspective to personal finance and provide valuable insights on budgeting, saving money, and investing wisely.

1. The Black Girl’s Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your Dreams By Paris Woods

Through a combination of personal stories and actionable advice, Woods provides a roadmap for Black women to gain financial freedom.

This book includes steps for women to take control of their money and build wealth. It also discusses managing money in relationships, increasing net worth, and building generational wealth.

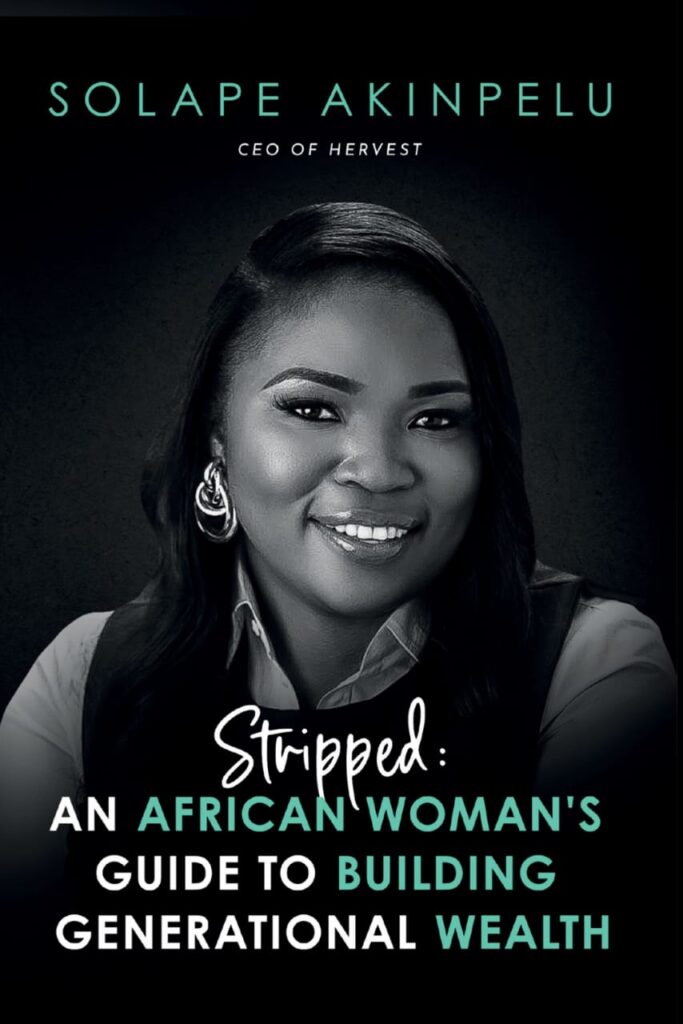

2. Stripped: An African Woman’s Guide to Building Generational Wealth by Solape Akinpelu

This book is widely celebrated for its actionable strategies that support African women in building and managing generational wealth. The book serves to answer the burning questions and allay the commonest fears that most African women have when it comes to managing their money and building wealth. It also establishes the need for a mindset reorientation with practical guides and steps to guide African women in trans-generational wealth-building.

3. Get Good with Money by Tiffany the Budgetnista Aliche

This book covers investing, budgeting, debt repayment, and savings providing readers with the knowledge and tools to make informed financial decisions, create a budget, and understand their relationship with money through relatable stories and personal experiences.

4. The One Week Budget by Tiffany the Budgetnista Aliche

This book offers a step-by-step plan to help you create a comprehensive budget tailored to your financial goals and needs in just one week.

With a straightforward approach, Aliche outlines the five steps to budgeting success: tracking, cutting, automating, increasing, and protecting. She provides detailed guidance on tracking expenses, cutting costs, automating payments, increasing income, and protecting your finances. The One Week Budget also includes helpful budgeting resources, tips, and exercises to help you stay motivated and on track.

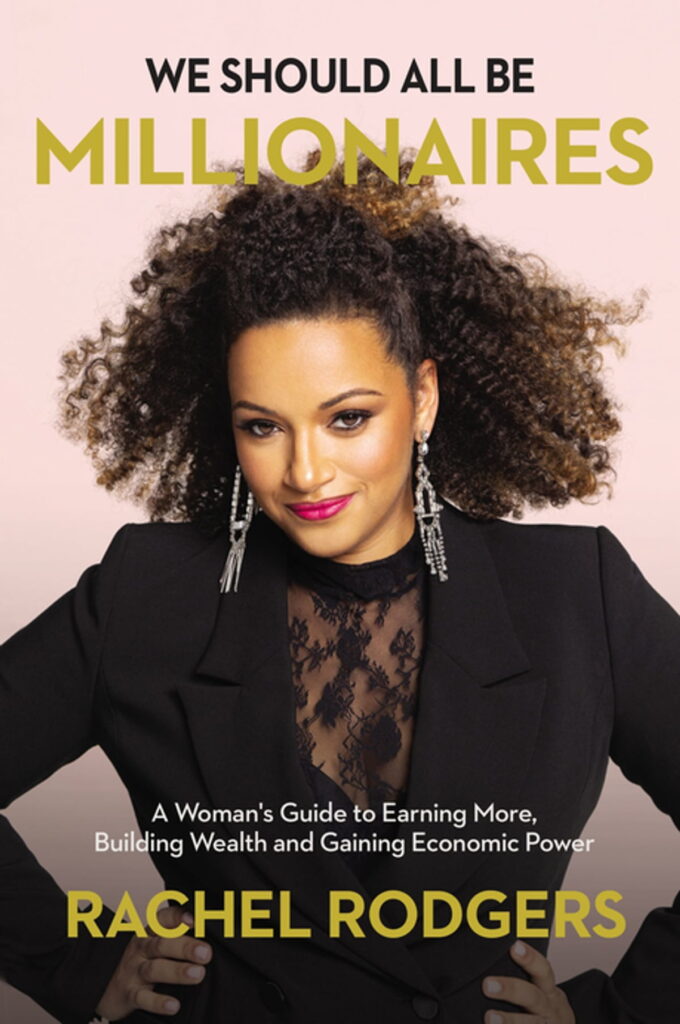

4. We Should All Be Millionaires by Rachel Rodgers

In We Should All Be Millionaires, Rachel Rodgers encourages her readers to pursue financial freedom by making the most of their current resources and taking ownership of their lives.

She argues that anyone can become a millionaire, no matter their financial situation, by taking control of their finances and using them to create a better future. Rodgers also outlines the steps to build a successful business, manage debt, and create wealth.

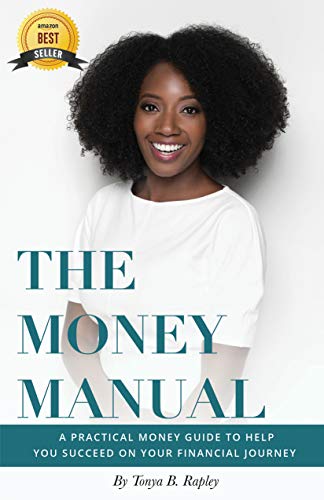

5. The Money Manual: A Practical Money Guide to Help You Succeed on Your Financial Journey By Tonya Rapley

This book is divided into three sections:

Building a Foundation: This section teaches the basics of financial literacy, including budgeting, saving, and planning.

Establishing Goals: This section focuses on creating and executing a plan to reach financial goals.

Taking Action: In the final section, you’ll learn how to make your financial goals a reality, including strategies for investing, debt management, and building wealth.

6. Financial Freedom for Black Women: A Girl’s Guide to Winning with Your Wealth, Career, Business, and Retiring Early —With Real Estate, Cryptocurrency, Side Hustles, Stock Market Investing, & More! by Brandie Brookes

This book addresses the unique challenges Black women face when trying to build wealth. It offers realistic advice on topics such as budgeting, investing, and building credit, as well as strategies for tackling debt and how to build generational wealth.

It also includes inspiring stories of successful Black women who have achieved financial freedom.

7. Clever Girl Finance: Ditch Debt, Save Money, and Build Wealth by Bola Sokunbi

This book is broken into three parts:

Money Mindset: Sokunbi discusses how to develop a positive relationship with money, including how to identify and change negative money thoughts and beliefs.

Get Control of Your Finances: This section focuses on money management, from budgeting and tracking expenses to setting financial goals and building an emergency fund.

Get Rich: This section covers strategies to grow wealth, such as investing, starting a side hustle, and building passive income streams.

Sokunbi also provides actionable advice, inspiring stories, and personal anecdotes to help her readers gain financial freedom.

8. Fearless Finances: A Timeless Guide to Building Wealth by Cassandra Cummings

This book covers budgeting, saving, investing, debt management, insurance, and retirement planning.

Cummings provides clear instructions and strategies to help you make smart financial decisions, overcome your fears around money, build a legacy of wealth, and achieve long-term financial security.

We hope these black female authors will inspire you to take your finances seriously this year.

Source: baucemag.com